Investing for Growth: How to Double Your Money in India

How to Double Your Money in India

Choosing the right investment options for doubling your money along with minimizing the risks can be difficult. In this blog, we will take a look at ways to double your money in India by 2023. We stress the importance of learning about investment options with high returns, diversification, risk assessment, setting financial goals, and considering your time horizon. Seeking professional advice, avoiding scams, starting small, and keeping track of your investments are all important. We talk about various investment options for you to choose the best out of them. Remember, all investments carry inherent risks, so thorough research and professional guidance are essential.

Precautions before doubling your money

Education about the investment options:

When it comes to investing, a strong basis of knowledge is essential. One should take some time to learn about different investment plans and understand the risks associated with it. It’s critical to have a thorough understanding of the investment’s risks, returns, and liquidity. Gain financial literacy to make sound choices.

Diversification:

Diversifying your portfolio across different types of assets helps to reduce risk. You reduce the influence of a single investment’s performance on your total assets by diversifying your investments. Investigate various investments to build a well-rounded portfolio.

Learn more about p2p lending platforms to diversify your portfolio.

Risk Evaluation:

Knowing your risk tolerance is essential for successful investing. Think about your ability to deal with market volatility and potential losses. It is essential to match your investment preferences to your risk tolerance. Remember that not all investments are suited to everyone, so make an informed decision based on your particular situation.

Financial Objectives:

Setting clear and attainable financial goals is important. Doubling your money quickly is not always feasible or prudent. Concentrate on long-term growth and match your investment strategies to your goals. Are you putting money aside for retirement, a down payment on a house, or your child’s education? Define your objectives to help guide your choices for investing.

Time Horizon:

Think about your investment time horizon—the time frame in which you hope to achieve your financial objectives. Short-term investments can often be riskier, whereas long-term investments can provide both security and growth potential. Determine your time horizon and choose investments that match.

Professional Advice: Seeking advice from a qualified financial advisor or consultant can be extremely beneficial. These experts can provide tailored advice based on your specific financial situation, level of risk tolerance, and targets. They can provide information, assist you in developing a solid investment strategy, and guide you through changes in the market.

How to Avoid Scams:

Financial scams and frauds promising unrealistic returns are nevertheless common. Stay vigilant and conduct thorough research to safeguard yourself. Investment opportunities that seem too good to be true usually are fraudulent. Check the reliability of investment options before investing funds.

Start Small: If you’re unaccustomed to investing or have been unsure about a specific opportunity, it’s best to start off small. You can learn, evaluate risks, and adjust your strategy by gradually dipping your toes into the investment waters. Beginning small allows you to gain experience and confidence as you gradually expand your investment portfolio.

Monitoring and evaluation: Investments demand constant monitoring throughout. Monitor your investments and evaluate the performance of your portfolio on a regular basis. One should keep up to the latest market trends and be ready to make adjustments as needed. Review your financial goals constantly to ensure that your investments are still in line with your changing circumstances

To know more about different investment plans check out best 1 year investment plan

Best ways to double your money

Stocks:

- Tenure: Long-term investment.

- Minimum Amount: There is actually no minimum investment requirement in the stock market; you can purchase shares for as little as INR 10 or as much as INR 10,000.

- Risk Appetite: Moderate to high, as there are no assurances of profit .If a company performs poorly or loses favour with investors, its stock price may fall, resulting in investors to lose money.

- Volatility: Stocks are well known for their short-term volatility.

- Best for: Investors with a higher risk appetite, willing to perform extensive research and actively manage their portfolios.

Cryptocurrencies:

- Tenure: Long-term investment.

- Minimum Amount: Varies depending on the cryptocurrency. One can invest as low as ₹100 in bitcoin.

- Risk Appetite: Very high, as cryptocurrencies are highly volatile, there is lack of regulation and cyber risks are involved.

- Volatility: Cryptocurrencies are highly volatile.

- Best for: Investors with a high-risk tolerance and who seek direct exposure to digital currency demand

Index Funds:

- Tenure: Long-term investment.

- Minimum Amount: In India, the minimum investment amount for S&P 500 index funds is INR 500.

- Risk Appetite: Moderate, as index funds are still exposed to market changes and the performance of the index’s underlying stocks.

- Volatility: Highly influenced by the overall market performance

- Best for: Long-term investors and beginners looking for passive investment options consider this option

IPOs (Initial Public Offerings):

- Tenure: Short to medium term investment.

- Minimum Amount: Varies depending on company to company.

- Risk Appetite: High. In the early stages of a company’s public listing, IPOs can be unstable and risky. They are also affected by valuation and market conditions.

- Volatility: IPO prices can fluctuate significantly

- Best for: Investors with a high risk appetite and the ability to research and assess newer companies.

REITs (Real Estate Investment Trusts):

- Tenure: Long term investment.

- Minimum Amount: Ranges from INR 10,000 to INR 15,000

- Risk Appetite: Moderate, because it is dependent on the performance of the real estate market and changes in the interest rates.

- Volatility: Prices can be influenced by real estate market conditions.

- Best for: Investors seeking regular earnings with longer holding periods, more readily available investment options, and an opportunity for capital appreciation.

To know more about different investment options, check out best 5 year investment plans

How Long it takes your money to be doubled?

The Rule of 72 is a popular shortcut for determining how long it will take for an investment to double if its growth rate increases year after year. Simply divide 72 by the expected annual rate of return. The outcome is the number of years required to double your money.

The rule of 72 provides a reasonably accurate estimate of doubling time for low rates of return. However, at very high rates of return, this estimate becomes less precise, as shown in the table below, which compares estimates for “time to double” (in years) calculated using the rule of 72 with the actual number of years it would take for an investment to double in value.

Rate of Return | Rule of 72 | Actual Number of Years |

|---|---|---|

2% | 36.0 | 35.0 |

3% | 24.0 | 23.5 |

5% | 14.0 | 14.2 |

7% | 10.3 | 10.2 |

9% | 8.0 | 8.04 |

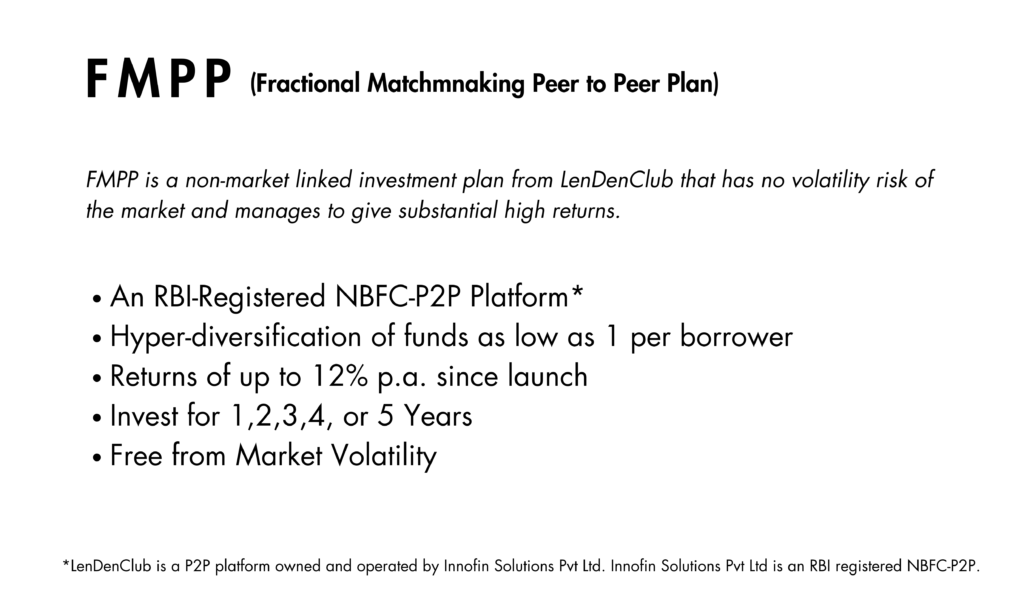

12% (FMPP) | 6.0 | 6.1 |

25% | 2.9 | 3.1 |

50% | 1.4 | 1.7 |

72% | 1.0 | 1.3 |

100% | 0.7 | 1.0 |

It is important to understand that the strategies discussed in this blog do not guarantee the doubling of your money. Before making any financial decisions, it is vital to undertake deep research and get professional guidance because all investments have inherent risks. Take personal responsibility for your choices and remember that no investment is entirely risk-free.

Team LenDenClub

LenDenClub is India’s largest alternate investment platform which started operations in India in 2015. We have been helping investors diversify their investments beyond traditional investment instruments ever since.