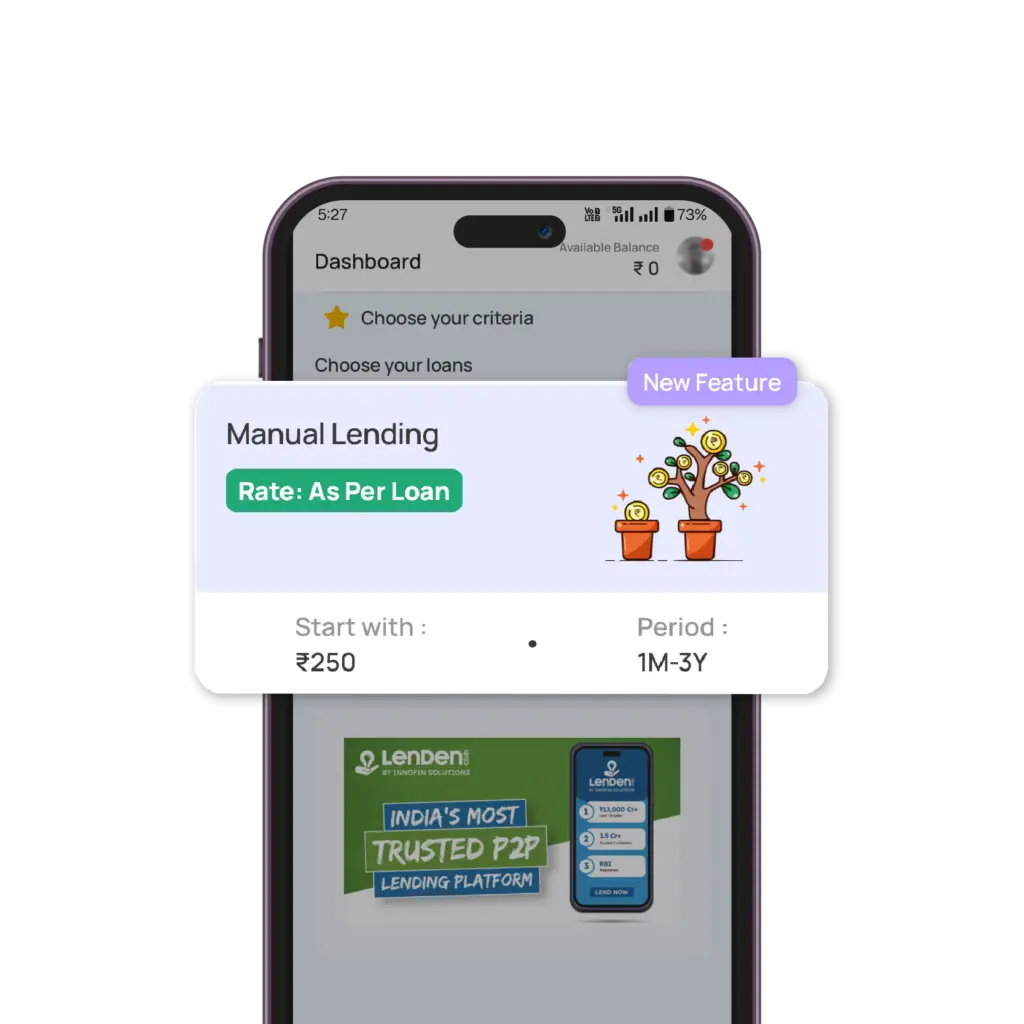

Manual Lending- Where You Choose Your Borrowers

Pick your own borrowers to lend.

Meet the future of P2P lending. Take control of your lending with our latest offering.

- Start Lending from ₹ 250

- Pick your own loans

- Earn Attractive Interest

What is manual lending?

Experience a new way of lending that puts you in control. Select your borrowers manually based on your criteria. Lend on loan tenure starting with 1 month and up to 36 months.

Loan selection

You can manually select borrowers based on demographic, financial, and credit information.

Flexible Loan Tenures

You can choose to lend for short—or long-term loan tenures, starting with one month and going up to 36 months.

Lend as low as ₹250

You can start lending with as little as ₹250. This allows you to diversify your money into multiple loans to mitigate risk.

How to lend manually with LenDenClub?

Risk and how to mitigate

Lending in loans via manual lending involves risks. While manual lending offers the potential for attractive interest, lenders need to understand that losses can and do occur.

Potential Defaults

Lending comes with default risk. Although there are stringent credit checks, default risk may not be completely mitigated.

Delayed Payments

There are possibilities of delayed repayments. Lenders should be aware of this before lending.

Market Conditions

Adverse market conditions may affect borrowers’ repayment capacity and result in delays or defaults.