Hyper-diversify your funds with FMPP®

Fractional Matchmaking Peer to Peer Plan (FMPP®) is designed to help you earn good returns while reducing the risk significantly. FMPP® lenders have earned up to 13% p.a.* till date with zero principal loss.

Hyper-diversify your funds with FMPP®

Fractional Matchmaking Peer to Peer Plan (FMPP®) is designed to help you earn maximum returns while reducing the risk significantly.

- This plan has been discontinued. Log in to the application to explore available lending options.

Some of the products

Lending options to meet your financial goals

About FMPP®

It’s a loan-matching algorithm designed to make effective matchmaking between lender and borrower to achieve maximum diversification across a maximum number of loans.

- As the name says, we take the lowest possible fraction of your amount lent to invest in loans as low as Re. 1 to mitigate risk.

- You can lend up to 50 Lakhs.

- FMPP® has given simple interest of up to 13% p.a.* since the launch

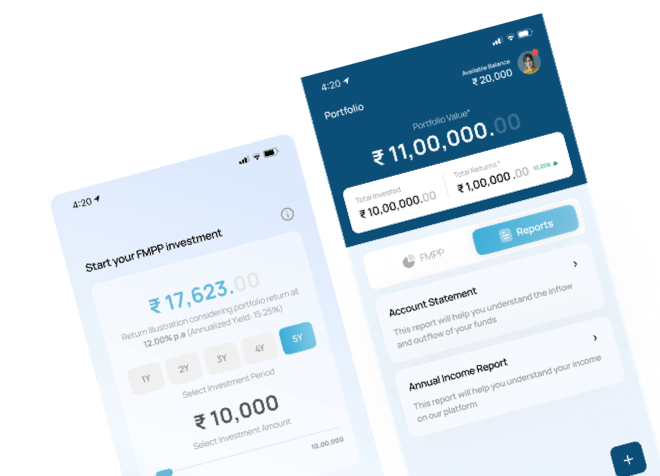

Find out how much return you can earn if invested in FMPP®

Calculate Returns

Values shown here are only for illustration and as per historical simple interest earned by lenders on the platform. Actual simple interest may vary.

Loan curation and due-diligence methodologies

How does the platform curate the best loans

Advanced Data

We collect hundreds of data points from the borrower to assess their creditworthiness

Credit Underwriting

We have advanced algorithms that thoroughly review the collected data before processing the loan request.

Robust Automation

We use machine learning and artificial intelligence to ensure robust credit check.

We don’t just say, we achieve results!

FMPP® Quarterly Performance

In the last quarter, FMPP® lenders have earned upto 12% p.a. since launch

You can make the best use of your funds by lending in FMPP®.

Avg Returns p.a. in March 2024

What makes FMPP® different?

Hyper-diversification

Funds hyper-diversified; as low as ₹1 per borrower to mitigate risk.

Matchmaking

We do match making between an lender and borrower to ensure you earn the best return.

AI / ML Powered

End-to-end automated processes and advanced algorithms used for lending.

What are the risks, and how do we reduce them

There's some risk

Credit Default Risk: LenDenClub Peer to Peer Lending platform puts its best efforts into sourcing the right borrowers, and do thorough underwriting, information verification, and KYC checks. However, there is still a possibility of fraud or credit default risk for the borrower. It’s part and parcel of any lending activity. Here, your money is lent into loans. In a way, it’s a lending activity. Though LenDenClub’s platform’s performance is good, and it delivered good results in the past, it is vital for you to understand the risk involved in the investment. To mitigate this risk, the amount you have lent should be divided into small amounts. On the LenDenClub platform, the capital matching algorithm helps you achieve the same.

Collection Risk: If a borrower does not repay, the platform uses various channels (which follow all RBI-specified guidelines) to recover the funds and ensure you receive your funds back. This includes digital follow-ups, physical meetings with the borrower, and initiating a legal recovery process against the borrower. Based on the loan amount, outstanding amounts, and physical connectivity of the place, the platform decides on the type of collection efforts in the best possible way. Again, because your lending amount are divided into hundreds and thousands of loans, the effect of non-repayment by a particular borrower will be very minimal.

We hate to keep anything hidden. Here are the platform fees you should know about.

Platform fees

Fees and Charges: To ensure that our P2P lending platform operates effectively and efficiently, while generating good returns for our lenders, a few fees and charges are applicable. Transparency is a key aspect of our service, and therefore, it’s crucial for you to understand these charges and why they are essential for a successful lending experience.

Facilitation Fee: This fee is charged for the range of services we provide to make lending smooth and hassle-free for you. The Facilitation Fee covers the costs associated with running the platform for lender-borrower matching, maintenance of a secure and user-friendly platform, and effective customer support. It ensures that we can continue to deliver an efficient and convenient lending experience for you.

Collection Fee: The Collection Fee is applicable only when we set up with an external vendor or collections partner to manage loan repayments. This helps streamline the collections process while following all applicable guidelines, ensuring that you receive your simple interest in a timely manner. This fee is a small investment towards making the repayment process as smooth as possible.

Recovery Fee: This fee is only applicable on successful repayment of the delinquent loan from the borrower to the lender. The Recovery Fee is levied for the additional efforts our team puts into ensuring that delinquent loans are repaid, including any follow-ups and legal steps that may be required. The fee is a testament to our commitment to go the extra mile to safeguard your lending amount.

Each of these fees contributes to the overall effectiveness of our platform, enabling us to offer you a robust, trustworthy lending service. The aim is not only to cover the operational costs but also to reinvest in technology and human resources to make our platform even better. This helps us continue to deliver on our promise of being a reliable investment avenue for you.

Some testimonials

Hear from our Lenders

The new FMPP® product is good. Was confused initially, but the support team helped me get clarity. The results in past quarter are reassuring. Keep up the innovation guys.

Love the overall experience. Never had to be worried about the nitty gritty of P2P investment. LenDenClub takes care of it with its FMPP® plan. The returns received were exactly as promised.

I really like this product for two reasons. One, they have a track record of good returns, and second, their support staff is extremely polished and guides you well.

Ready to start diversifying your funds?

Diversify your investments with LenDenClub and increase your overall portfolio value. Download the LenDenClub app to start lending in P2P!