Upgrade your portfolio. Lend to high-quality, creditworthy borrowers.

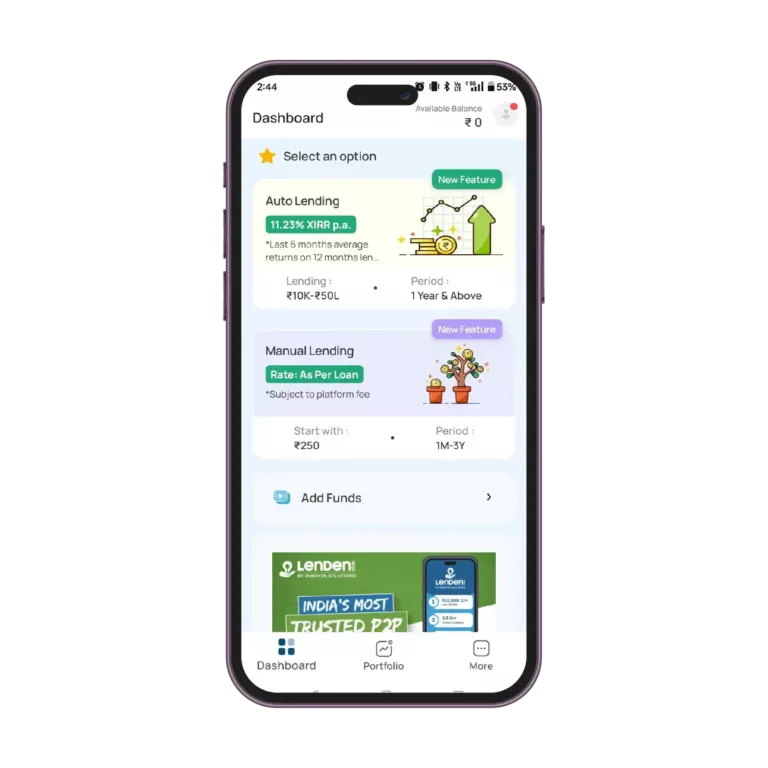

Lenders at LenDenClub have historically earned an XIRR 11.28% p.a. Don’t miss out. Diversify your portfolio with India’s largest peer-to-peer lending platform today!

★★★★½

Highly Rated

NBFC-P2P

RBI Registered

₹ 15,000 Cr+

Lent So Far

2 Crore+

Registered Users

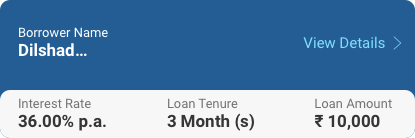

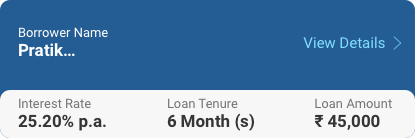

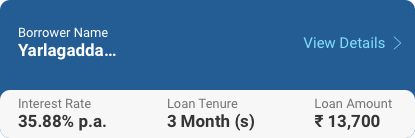

Diversify your portfolio in loans

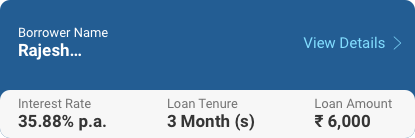

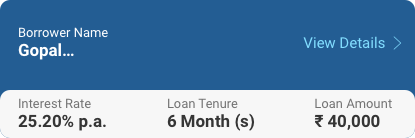

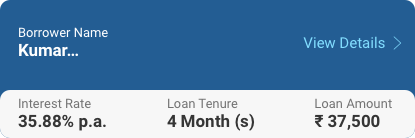

Here’s a sample list of loans. You will get to lend in thousands of such loans. Get started now.

Why lend in Peer to Peer lending with LenDenClub?

Lending opportunities crafted for best simple interest

Portfolio Diversification

Think beyond the traditional market-linked instruments.

Minimum Lending Amount

Start your lending journey with as low as ₹ 250.

Attractive Simple Interest

Grow your wealth by earning interest from loans

Everything you need to get started!

What is P2P Lending?

Peer-to-peer (P2P) lending is an alternative financing model that connects individual borrowers and lenders, bypassing traditional financial institutions. Originating in 2012, this form of lending has gained momentum globally and notably in India, where it gained legal recognition in 2018 through guidelines from the Reserve Bank of India. Expected to grow at a CAGR of 21.6% to reach USD 10 billion by 2026, P2P platforms offer various loan types, such as personal, business, and medical loans. Borrowers apply online, undergoing a KYC process and credit assessment. Lenders can then choose which loans to fund based on risk and simple interest profiles. Despite its growth and role in financial inclusion, the industry faces challenges like default and fraud risks. Therefore, both borrowers and lenders should thoroughly evaluate the terms and platform performance before engaging in P2P lending. You can learn more about it in our detailed article about peer to peer lending.

Why settle for less when you can earn better interest with us?

Here are a few reasons why lakhs of people have lent in peer to peer lending with LenDenClub

Core values of the platform that deliver great results

100% Digital Process

Fund Diversification

No Withdrawal Fee

There is no charge for the withdrawal of your funds. You can get your funds in your bank a/c within 24 hrs of placing a request post maturity.

Zero Opening Fee

Opening an account on the platform costs you nothing. Open your P2P lending account at zero cost in less than a few minutes.

It’s simple. It’s digital. It’s P2P lending.

Three easy steps to start lending.

Sign up using mobile number

Complete your KYC

Start Lending

Ready to start diversifying your funds?

Diversify your Lending with LenDenClub and increase your overall portfolio value. Download the LenDenClub app to start lending in P2P lending!

What our lenders ask?

Frequently asked questions (FAQs)

LenDenClub, a Peer to Peer Lending platform puts its best efforts into sourcing the right borrowers, and do thorough underwriting, information verification, and KYC checks. However, there is still a possibility of credit default risk for the borrower. It’s part and parcel of any lending activity. Here, your money is lent into loans. In a way, it’s a lending activity. Though LenDenClub’s platform’s performance is good, and it delivered good results in the past, it is vital for you to understand the risk involved in the lending. To mitigate this risk, your lent amount should be divided into small amounts. On the LenDenClub platform, the capital matching algorithm helps you achieve the same.

The minimum amount you can lend in LenDenClub is ₹250 and the maximum one can lend is ₹2,000 per loan.

As the name suggests, P2P lending (peer-to-peer lending) is a concept in which individuals or institutes can lend money to borrowers. The system removes the role of a financial institution as an intermediary. Instead, P2P lending platforms act as facilitators for the transaction of money.

Anyone can become a lender on P2P lending platforms and effectively lend to many individuals or businesses from their homes. This mode of lending and borrowing has increased its adoption as an alternate way of financing.